by Atharva C.

Introduction

In this comprehensive exploration, we delve into the intricate landscape of the motor insurance industry, shedding light on how the integration of large language models and artificial intelligence (AI) has fundamentally altered its dynamics. To fully appreciate the profound impact of these technological advancements, it is imperative that we first gain a comprehensive understanding of the core processes intrinsic to this industry.

Understanding the Motor Insurance Industry’s Processes

The motor insurance industry comprises a set of essential processes that shape the customer experience and determine the efficiency of claims processing. These processes can be broken down into four distinct phases:

- Reporting: It all begins when a policyholder reports an incident or claim to their insurance provider. This reporting can take various forms, including phone calls, emails, or the use of online portals.

- Investigating: The investigation phase is pivotal, as it involves a meticulous examination of the claim. Claims adjusters play a crucial role during this stage, gathering vital information such as medical reports, police records, witness statements, and other pieces of evidence to assess the validity of the claim.

- Agreements: Once the investigation is complete, an agreement is reached between the insurer and the claimant regarding the terms of the settlement. This phase is pivotal in determining how the claim will be resolved.

- Payments: The final step involves the insurer disbursing the claim amount to the claimant. This payment can be made as a lump sum or in instalments, depending on the agreed-upon terms.

Challenges in the Motor Insurance Industry

While these processes seem straightforward, the motor insurance industry grapples with several formidable challenges, primarily clustered into four verticals:

- Time Consuming: Providing swift support to loyal customers while expediting the claims process is of paramount importance. Delays can lead to customer dissatisfaction and impact the insurer’s reputation.

- Cost: High-cost claims can significantly erode profit margins. Finding ways to efficiently manage and reduce these costs is a perpetual challenge for insurance companies.

- Frauds: The industry faces an alarming rise in the number of false claims and fraudulent activities. Detecting and preventing these fraudulent claims is crucial for the sustainability of insurers.

- Bulky Operations: The manual processing of extensive data makes operations unwieldy, time-consuming, and prone to errors. Streamlining these operations is a pressing concern.

How Artificial intelligence and LLMs are solving the problems?

- Swift Claims Processing: AI quickly analyses data, improving accuracy and expediting genuine claims while flagging fraud.

- Fraud Detection: AI’s data analytics spots irregularities, aiding insurers in detecting and preventing fraudulent activities.

- Rapid Underwriting: AI streamlines underwriting, automating tasks and enhancing risk assessment for faster policy issuance.

Addressing Challenges with Technology

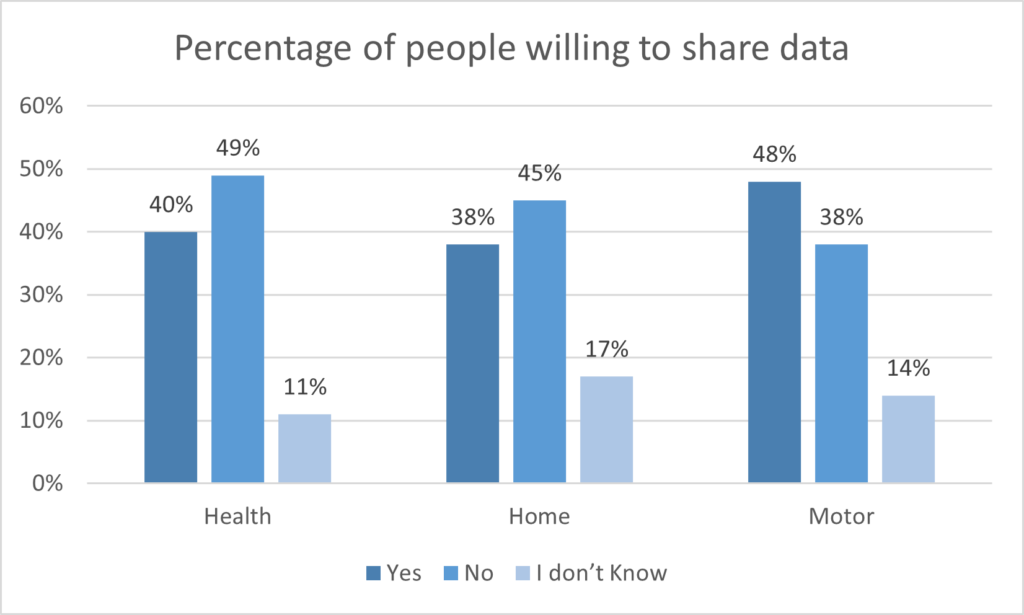

Fortunately, the rise of cognitive technologies, including AI and large language models, has ushered in a new era of intelligence, significantly accelerating the pace of innovation in the insurance industry. In 2017, AI showcased its potential across various sectors, with insurance being no exception. AI not only offers the automation of routine tasks but also enhances service quality by aiding agents in making informed decisions and irrefutable judgments. Moreover, there is a growing willingness among customers to share their data with insurers in exchange for more accurate premium calculations.

Investments in AI within the insurance sector have witnessed a remarkable surge. Insurers are primarily focusing on three key segments for AI implementation:

- Product Innovation: AI is driving innovative product development in the insurance sector. Insurers are leveraging AI to create new policy offerings that are better tailored to individual customer needs. For instance, AI-powered telematics devices can monitor driving behavior and offer personalized premium rates.

- Process Implementation: AI is streamlining internal processes within insurance companies. Tasks such as claims processing, underwriting, and fraud detection are being automated, resulting in faster and more efficient operations.

- Customer Experience: AI is revolutionizing the way insurers interact with their customers. Chatbots and virtual assistants powered by natural language processing (NLP) are improving customer service, providing instant responses to inquiries, and enhancing overall customer satisfaction.

A Case Study: AXA and Google TensorFlow

To illustrate the tangible impact of AI in the motor insurance industry, let’s examine a compelling case study involving AXA, a prominent player in the insurance sector, and Google’s TensorFlow.

Approximately 7-10% of AXA’s customers are involved in car accidents each year. While most of these accidents result in relatively small insurance payouts, around 1% fall into the category of large-loss cases, necessitating payouts exceeding $10,000. It is vital for AXA to identify clients at a higher risk of being involved in these large-loss cases to optimize policy pricing.

Initially, AXA’s research team in Japan focused on employing a traditional machine-learning technique known as Random Forest. This algorithm utilizes multiple Decision Trees to make predictive models based on various factors that could contribute to a driver causing a large-loss accident. However, Random Forest’s prediction accuracy was found to be inadequate, measuring at less than 40%.

In contrast, the team undertook an experimental approach by developing a deep learning (neural-network) model using TensorFlow through Google’s Cloud Machine Learning Engine. The results were astonishing, with the experimental model achieving an impressive prediction accuracy rate of 78%. This breakthrough holds the potential to provide AXA with a significant advantage in optimizing insurance costs and pricing. Furthermore, it opens the door to innovative services, such as real-time pricing at the point of sale, which can be tailored to a driver’s risk profile.

Conclusion

The motor insurance industry is undergoing a profound transformation, driven by the integration of AI and large language models. These technologies are not only streamlining processes and enhancing accuracy but also revolutionizing the way insurers interact with their customers. As we look to the future, the insurance landscape is poised for continued evolution, promising new possibilities and opportunities for insurers and policyholders alike. The use of AI and large language models has not only changed the dynamics of the motor insurance industry but has also set the stage for a future where insurance is more personalized, efficient, and responsive to customer needs.

References

https://www.oecd.org/finance/Impact-Big-Data-AI-in-the-Insurance-Sector.pdf