By Rani Patade

Introduction

How AI transforms financial advisory practices with real-time insights

The growing complexities of financial advisory demand innovative solutions — staying ahead of the curve is essential for delivering value to clients. Enter AI-powered platforms designed to give advisors real-time, independent insights at their fingertips. For the past several months, forward-thinking financial professionals have been turning to these tools to navigate market volatility, identify opportunities, and make data-driven decisions with confidence.

Our research highlights how industry professionals are leveraging AI-driven analytics to streamline decision-making, enhance portfolio management, and ultimately improve client outcomes. With advanced AI capabilities, financial advisory is no longer about reacting to market changes — it’s about anticipating them.

The value of AI in Financial Advising

By harnessing AI, financial advisors can access real-time insights drawn from a vast pool of market research, independent analysis, and fund data — all through intuitive, easy-to-use platforms. This technology saves time, reduces errors, and equips advisors with valuable information that strengthens client conversations.

AI-powered assistants can process natural-language queries, scan and understand thousands of analyst reports, aggregate investment data, and deliver actionable, verifiable insights in seconds. Advisors get precise answers instantly, freeing up more time for strategic, high-value work. As users interact with these systems, their questions and feedback continuously refine the platform’s capabilities, enabling seamless access to large datasets, advanced processing power, and AI-driven recommendations.

How financial advisors are harnessing the power to enhance their practice

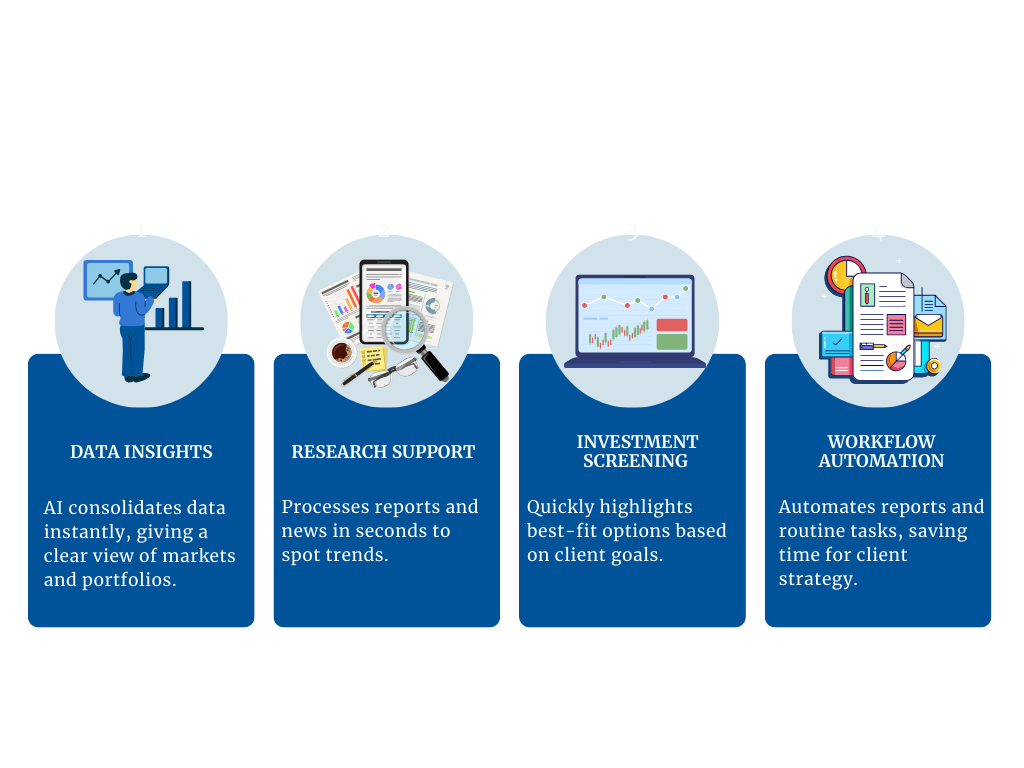

- Data Insights

Instead of spending hours pulling numbers from multiple sources, AI consolidates and cleanses data instantly. Advisors gain a single, reliable view of market activity, performance metrics, and client portfolios. - Research Support

AI can process thousands of analyst reports, company filings, and news articles in seconds. Advisors use it to spot patterns, uncover trends, and surface insights they might otherwise miss. - Investment & Fund Screening

Sorting through funds or investment opportunities is no longer manual. AI-powered screening tools highlight the best-fit options based on client needs, risk appetite, and market conditions—making portfolio construction faster and more precise. - Workflow Automation

From preparing client-ready reports to generating compliance documents, AI streamlines repetitive tasks. This not only saves time but also allows advisors to focus on high-value work: strategy, client engagement, and long-term planning.

How Advisors are harnessing the power of AI to enhance their practice

Advisors are finding new ways to integrate AI into their daily workflows—turning it from a “nice-to-have” into a core part of their practice. Some of the most impactful use cases include:

- Natural Language Queries → Instead of digging through lengthy reports, advisors simply ask a question and get instant, data-backed insights.

- Real-Time Market Insights → AI tracks market shifts as they happen, helping advisors respond quickly to volatility.

- Enhanced Research Efficiency → By processing analyst reports, financial filings, and news at scale, AI surfaces insights advisors might otherwise miss.

- Streamlined Reporting → From client summaries to portfolio reviews, AI reduces the time spent drafting reports—freeing advisors to focus on high-value conversations.

By adopting these practices, advisors aren’t just improving efficiency—they’re reimagining how financial advice is delivered in a more dynamic, personalized way.

Natural Language Queries

Natural language queries are transforming how financial advisors access insights. Instead of digging through endless data tables and reports, advisors can simply ask questions in plain English—and get clear, data-backed answers within seconds.

Example query:

“What is the current outlook for Indian mid-cap growth stocks?”

Why might an advisor ask this type of question?

Because it cuts hours of research down to seconds. Natural language queries help advisors:

- Save time: Skip manual searches and instantly surface the right insights.

- Personalize client interactions: Deliver tailored responses to client questions, backed by real data.

- Increase confidence: Access insights that are transparent and verifiable, reducing the risk of missing critical information.

By making research faster and more intuitive, natural language queries allow advisors to focus less on finding data and more on using it to strengthen client relationships.

Financial Advice Workflow Questions

Workflow questions help advisors use AI platforms more effectively—navigating features, analyzing data, and simplifying daily tasks.

Examples of workflow questions:

- Can you summarize this portfolio’s current composition?

- Highlight any key risks or opportunities in this quarter’s performance.

- Draft talking points for tomorrow’s client discussion based on current portfolio insights.

Types of workflow questions include:

- Portfolio Analysis – understanding composition, performance, risk exposure.

- Analytical Insight – detecting trends, anomalies, or noteworthy patterns.

- Client Communication – generating insights and summaries that inform advisory conversations.

Research questions

Research questions focus on deeper analysis of investments, market movements, or economic shifts. Advisors rely on these to uncover patterns, compare options, and build data-driven recommendations for clients.

Example research question:

What are the key factors driving Nifty 50 performance this quarter?

Why might an advisor ask this type of question?

Research questions help advisors:

- Gain clarity – quickly access AI-powered insights from vast datasets.

- Stay current – track market trends, sector performance, and company fundamentals.

- Build confidence – support recommendations with data-backed evidence rather than assumptions.

By transforming raw market data into actionable insights, AI allows advisors to deepen their research and deliver strategies that align closely with client objectives.

Data Questions

Data questions focus on retrieving specific figures, metrics, or ratings about securities, funds, or market indices. Instead of scanning lengthy reports, advisors can instantly access precise numbers to support their analysis and recommendations.

Example data question:

What is the current P/E ratio of Reliance Industries?

Why might an advisor ask this type of question?

Data questions are valuable because they:

- Save time – no need to search multiple reports for one metric.

- Enable precision – provide exact figures like valuations, returns, or volatility.

- Support conversations – allow advisors to answer client questions quickly and confidently.

With AI-powered tools, accessing these key data points becomes effortless, letting advisors spend more time focusing on strategy and client engagement.

Conclusion

AI is no longer just a buzzword—it’s becoming a trusted assistant for financial advisors. Instead of juggling multiple tools or digging through endless reports, AI-powered platforms bring everything together in one place. From answering workflow questions to assisting with investment screening, supporting research, and delivering real-time data, AI empowers advisors to work smarter, faster, and more effectively.

At AlgoFabric, we specialize in creating advanced AI-powered solutions designed specifically for financial advisors. Our platforms bring together real-time insights, powerful analytics, and intuitive tools in one place—helping advisors not only save time but also unlock deeper market intelligence. By streamlining workflows, enhancing research, and enabling data-driven portfolio decisions, we empower advisors to deliver smarter, faster, and highly personalized investment strategies. With AlgoFabric, financial professionals can move beyond traditional tools and embrace a future where every decision is backed by clarity, precision, and confidence.